How Fusion Startups Raise $100M+ to Build the Future of Energy

Commonwealth Fusion Systems has been cooking up recently, and people are no longer thinking about sci-fi movies when we

Commonwealth Fusion Systems has been cooking up recently, and people are no longer thinking about sci-fi movies when we imagine a star tucked inside a machine in Massachusetts. The old-time joke about fusion being a decade away is old as fusion startups raise $100M and we have got timelines, magnets, startups, and most importantly, Google on every proton smash.

SPARC is like the Wright Brothers moment for fusion tag-alongs, which are two brilliant minds, a doughnut-shaped reactor, and a fiery plasma that is just itching to break. ARC is like a building, the 747 after the Wright Flyer, but this time in Virginia. With the help of Google as its ground staff buying most of the seats or megawatts, fusion startups raise $100M in 2025.

If fusion has always felt like a sci-fi daydream, then CFS is turning it into a reality show and the funding this season’s blockbuster with $863 million in fresh Series B2 funding. So, buckle up and take this journey with us to understand how fusion startups raise $100M. You will also be learning about the real tale of how science, investors, and donut-shaped reactors are merging to power our future.

Funding and Gaining Momentum

Commonwealth Fusion Systems has quickly become a growing name by receiving funding and gaining momentum. CFS emerged as the funding magnet of the fusion startup world, and in its latest Series B2 round, CFS secured $863 million. This amount has pushed its total private capital raised to nearly $3 billion, and this single round alone accounts for roughly one-third of all private fusion investment in existence.

The company received a lot of investors like NVentures, which is NVIDIA’s VC arm, sovereign wealth funds, industrial giants, and Bill Gates as well. This is the type of funding that everyone uses to grow their tension and confidence. According to us, seeing this level of sustained and high-profile investment is very thrilling and exciting.

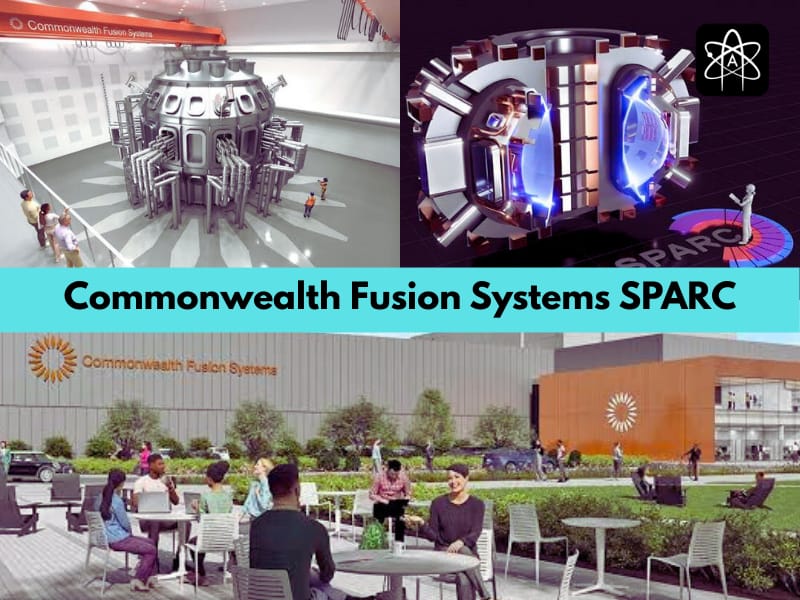

SPARC Fusion Demonstration Machine

SPARC is one of the bold moves from CFS, and it is a compact tokamak designed to achieve net-energy gain, where all our plasma generates more money. The construction is already underway in Devans, Massachusetts, and is targeted for 2026, and net energy is expected by 2027. SPARC is different from its use of high-temperature superconducting magnets and mostly YBCO tapes.

According to us, SPARC is the make-or-break moment for fusion’s commercial viability. The SPARC fusion demonstration machine will be delivered on its promise, and the whole industry could accelerate quickly. But if it falters, then fusion startups raise $100M will fall down and come to zero, and hence it has high stakes, but it is precisely where breakthroughs happen.

Commercial Fusion Plant ARC

The commercial fusion plant ARC is the first commercial-scale fusion power plant and is slated for Virginia. ARC is expected to produce around 400 MW of clean electricity, and this energy is enough to power about 150,000 homes. ARC is not just another plate in the fusion buffet, but it is also designed to integrate smoothly with the grid and operate like a natural gas plant.

Google has taken a leap of faith and signed a landmark agreement to buy 200 MW of power from ARC. These are so cheap, we will see become the world’s first corporate buyer of fusion story. According to us, ARC represents the true test of fusion’s commercial future, and if Google signs the deal, the major buyers will stake real capital now for fusion tomorrow.

Fusion Startups Raise $100M

The recent news that fusion startups raise $100M has not only surprised the entire internet but also announced its importance. In late 2022, the U.S. Department of Energy made an announcement that a controlled fusion experiment can achieve scientific breakeven. The fusion startups raise $100M news is the perfect testament of this.

The reason behind fusion startups raise $100M is the buy-in from strategic corporate partners. Google’s offtake agreement for 200 MW from ARC also gives CFS a committed customer after the fusion startups raise $100M news has faded.